rsu tax rate us

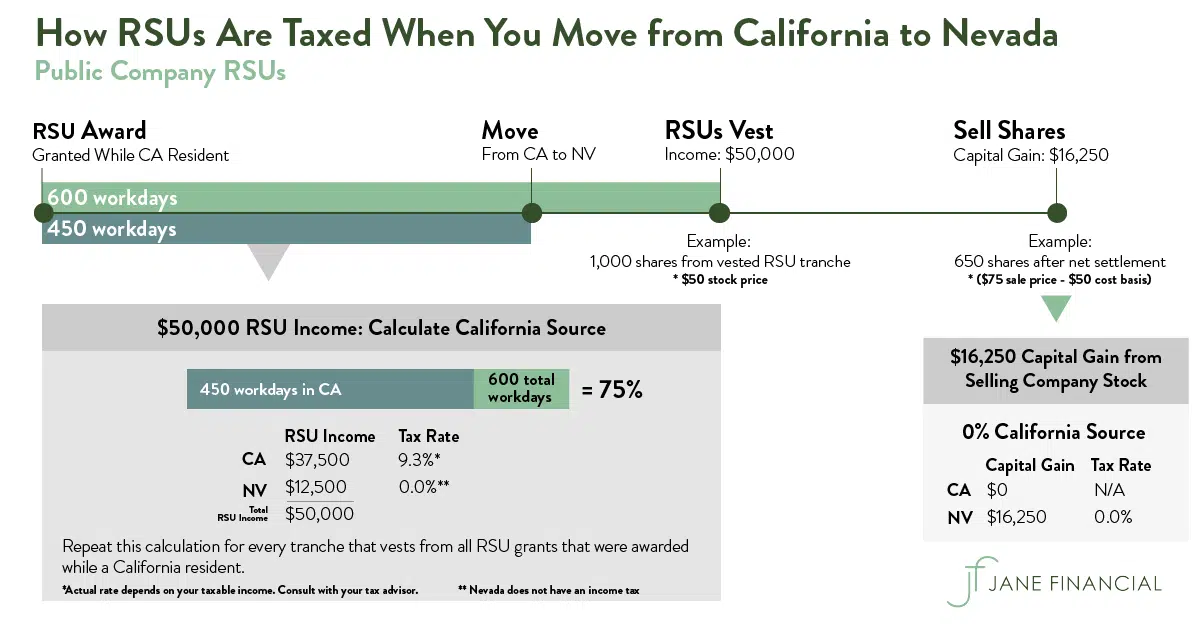

Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option. We do this by educating the workforce in alignment with our industry partners and regional stakeholders.

Nike Restricted Stock Understanding Rsus And Rsas Human Investing

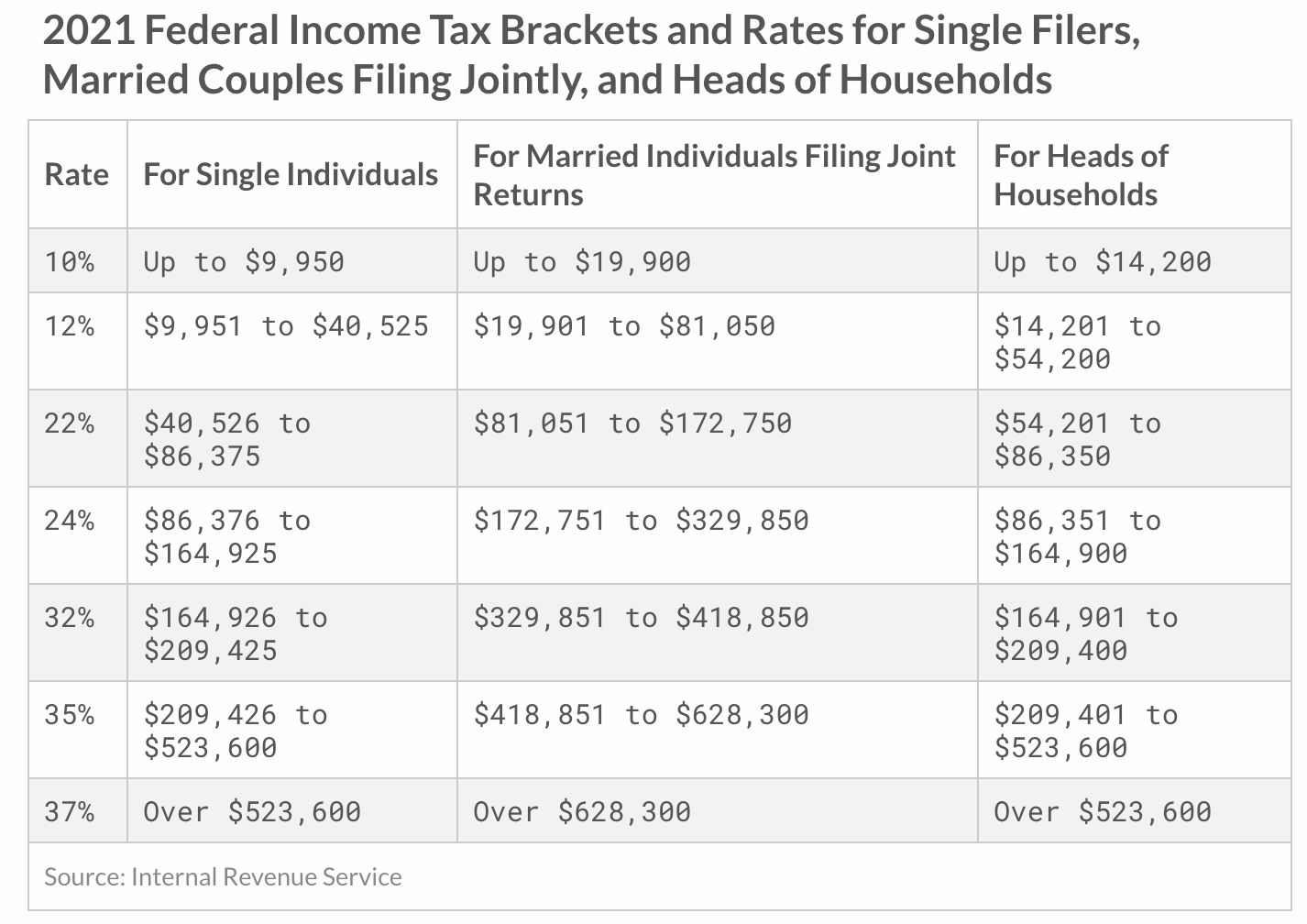

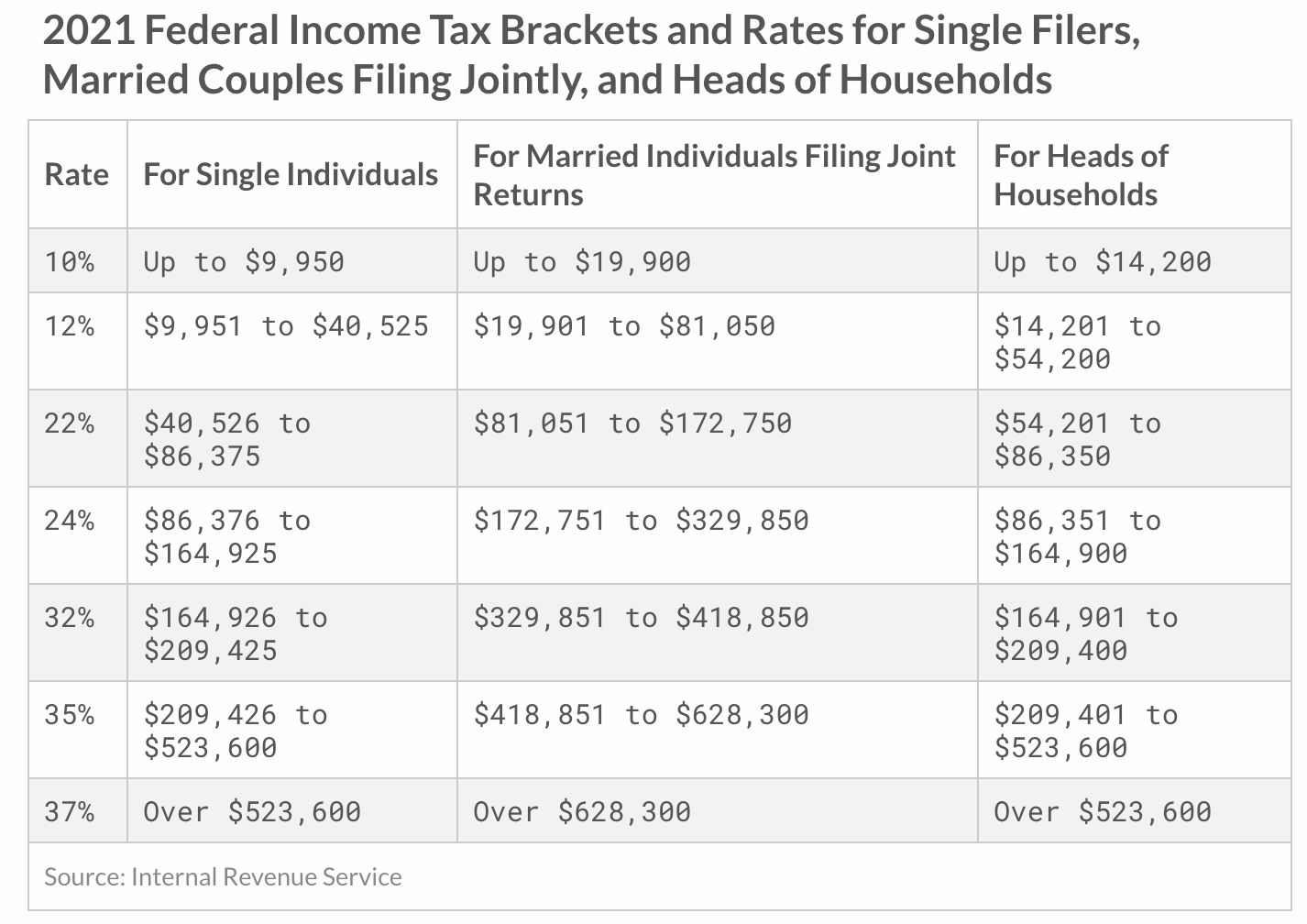

The 22 flat rate could result in too little being withheld for taxes depending on your tax bracket.

. How RSUs Are Normally Granted. SALES OF SHARES Status Expected Tax Form Amounts Issued By Form Deadline Employee W-2 FMV per share at vesting or delivery date Company Jan. For all RSA and RSU sales you will receive a 1099-B from Computershare.

The difference between US GAAP vs IFRS may look simple but they are enough to derive meaningful effects on investors and businesses to get the best results all over the. RSU vests are considered supplemental wages and are typically withheld by corporations at 22 percent which may not be enough if the dollar amount is sizable. Sometimes its also called tax basis because its whats used to figure out taxes.

So if your company grants you a 400000 total value and the shares of your company. If this is the case you could be paying more at tax time than you were expecting. This often catches Amazon employees off guard because of the tax consequences at years three and four.

Didnt have to buy the market price that they were on the day they vested. Some of the Command Economy examples are provided below. Consider submitting an amended Form W-4 to your.

And RSU vestings as well as dividends paid on unvested awards will be reported on your W-2. The most common and relevant example of a command economy is the Republic of China were after world war 2 the ruler of the country of China who was Mao Tse Tueng created an economy of communism. Once supplemental wages for the year exceed 1 million employers withhold at a flat rate of 37.

The difference between US GAAP and IFRS could impact important financial measures and a host of other metrics like financial ratios balance sheets taxes and loan covenants. Examples of Command Economy. A bipartisan group of US representatives reintroduces the Virtual Currency Tax Fairness Act which would exempt paying taxes on realized crypto gains under 200 The legislation by a bipartisan group of House representatives would.

In most RSU agreements you get a grant of RSUs expressed as a set dollar amount. Employers withhold at a flat rate of 22 on the first 1 million of supplemental wages paid out during the calendar year. For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess.

COMPENSATORY INCOME ELECTION METHOD. For RSU awards for which the 83b election was not made the holding period would begin on the vesting date and your capital gains tax short term if sold within the 1st year of vesting as applicable to each lot of shares would be based on the difference between the stock value at the time of sale minus the RSU share value on the date of that share lots vesting. The mission of RSU is to strengthen Oklahomas economic vitality and overall quality of life.

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

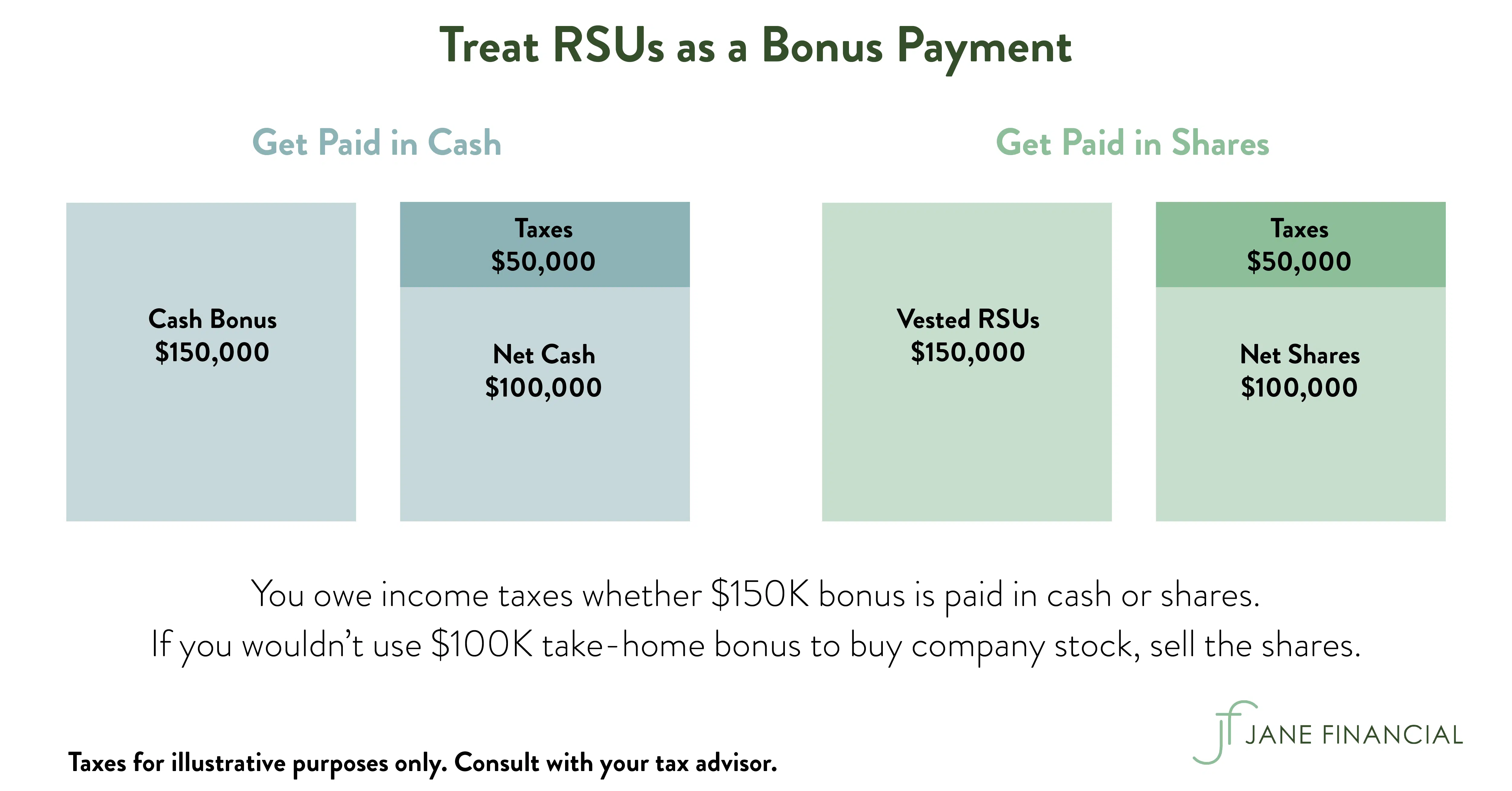

Restricted Stock Units Jane Financial

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Rsus Comprehensive Guide Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Are Rsus Taxed Twice Rent The Mortgage

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021